A Biased View of Amur Capital Management Corporation

Table of ContentsSee This Report on Amur Capital Management Corporation3 Simple Techniques For Amur Capital Management CorporationAmur Capital Management Corporation Fundamentals ExplainedNot known Details About Amur Capital Management Corporation An Unbiased View of Amur Capital Management CorporationHow Amur Capital Management Corporation can Save You Time, Stress, and Money.

The companies we adhere to require a solid record commonly a minimum of one decade of running background. This means that the company is likely to have actually faced a minimum of one economic slump and that administration has experience with hardship as well as success. We seek to omit firms that have a credit history top quality below investment grade and weak nancial stamina.A company's capability to raise rewards constantly can show protability. Companies that have excess cash money ow and strong nancial positions typically pick to pay returns to draw in and award their shareholders.

What Does Amur Capital Management Corporation Mean?

We've located these stocks are most in jeopardy of reducing their rewards. Expanding your financial investment profile can aid secure against market uctuation. Take a look at the following variables as you prepare to branch out: Your portfolio's property class mix is one of one of the most vital factors in figuring out performance. Consider the size of a business (or its market capitalization) and its geographical market united state, established worldwide or arising market.

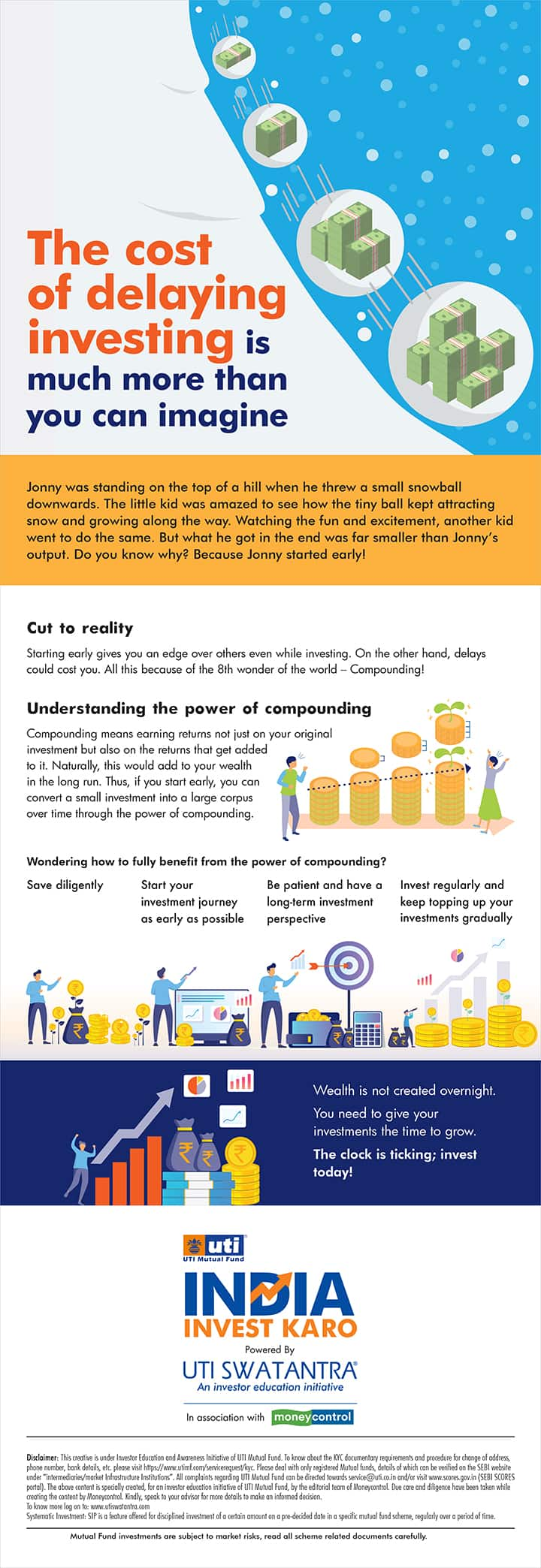

Regardless of how simple electronic investment management systems have made investing, it should not be something you do on an impulse. If you make a decision to get in the investing globe, one point to consider is exactly how long you really want to invest for, and whether you're prepared to be in it for the lengthy haul - https://www.gaiaonline.com/profiles/amurcapitalmc/46642563/.

There's a phrase usual linked with investing which goes something along the lines of: 'the sphere might drop, yet you'll desire to make sure you're there for the bounce'. Market volatility, when financial markets are going up and down, is a typical sensation, and long-lasting could be something to assist ravel market bumps.

The Ultimate Guide To Amur Capital Management Corporation

With that said in mind, having a long-term approach can aid you to take advantage of the marvels of compound returns. Joe spends 10,000 and gains 5% dividend on this financial investment. In year one, Joe makes 500, which is repaid into his fund. In year two, Joe makes a return of 525, due to the fact that not just has he made a return on his preliminary 10,000, but additionally on the 500 invested dividend he has actually made in the previous year.

The Single Strategy To Use For Amur Capital Management Corporation

One way you might do this is by obtaining a Stocks and Shares ISA. With a Stocks and Shares ISA. mortgage investment corporation, you can spend as much as 20,000 annually in 2024/25 (though this is subject to transform in future years), and you don't pay tax obligation on any kind of returns you make

Beginning with an ISA is truly simple. With robo-investing systems, like Wealthify, the tough job is done for you and all you require to do is choose just how much to spend and pick the threat degree that fits you. It might be one of minority instances in life where a much less emotional strategy might be valuable, but when it comes to your financial resources, you may desire to listen to you head and not your heart.

Remaining focussed on your lasting goals might assist you to avoid illogical choices based on your emotions at the time of a market dip. The tax obligation treatment depends on your specific situations and may be subject to change in the future.

What Does Amur Capital Management Corporation Do?

:max_bytes(150000):strip_icc()/foreign-portfolio-investment-fpi.asp-final-cfb0ab9482a644cdb1164ddedea9dcb6.png)

Spending goes one action better, helping you achieve personal objectives with 3 significant advantages. While conserving means alloting component of today's money for tomorrow, spending ways placing your cash to function to potentially earn a much better return over the longer term - investing for beginners in copyright. https://www.blogtalkradio.com/amurcapitalmc. Various courses of investment properties cash, taken care of rate of interest, building and shares typically create various degrees of return (which is about the threat of the financial investment)

As you can see 'Growth' possessions, such as shares and residential or commercial property, have traditionally had the best general returns of all property classes but have additionally had bigger heights and troughs. As a financier, there is the potential to earn capital growth over the longer term as well as a recurring revenue return (like dividends from shares or rent out from a home).

The Best Strategy To Use For Amur Capital Management Corporation

Rising cost of living is the continuous increase in the cost of living over time, and it can impact on our financial health and wellbeing. One way to help outmatch inflation - and generate favorable 'real' returns over the longer term - is by buying properties that are not just qualified of delivering greater income returns yet additionally offer the potential for funding growth.